In Brief

Tom Trowbridge, co-founder of Fluence took the stage at DePIN Day Dubai 2025 to answer a critical question: How does DePIN win?

His talk traced the rise of DePIN as the most resilient vertical in Web3: decoupled the broader crypto market, grounded in real-world traction and built on sustainable token economics. Backed by projects like GeoNet, HiveMapper and Fluence, Tom revealed how infrastructure sovereignty can be achieved through models that link revenue to tokens and hardware to scale.

Fluence: Redefining Cloud with DePIN

Founded to challenge the dominance of hyperscalers, Fluence is a decentralized compute network that connects excess CPUs in global data centers into an open, cost-efficient and cloudless infrastructure. Unlike GPU-heavy networks, Fluence focuses on the CPU market: billions of units powering everything outside of AI.

The Problem: Centralized Cloud Is Expensive and Locked

Today’s cloud infrastructure is controlled by a few hyperscalers, leading to:

High switching costs and lock-in

Opaque pricing models

Censorship risks via ToS enforcement

Misalignment with user needs

Web2 marketplaces like Airbnb and Uber extract high marketing spend and churn from providers. DePIN flips that model: compensating providers with tokens, offering lower effort and rewarding platform growth.

The Opportunity: Real Usage + Tokenomics = Value

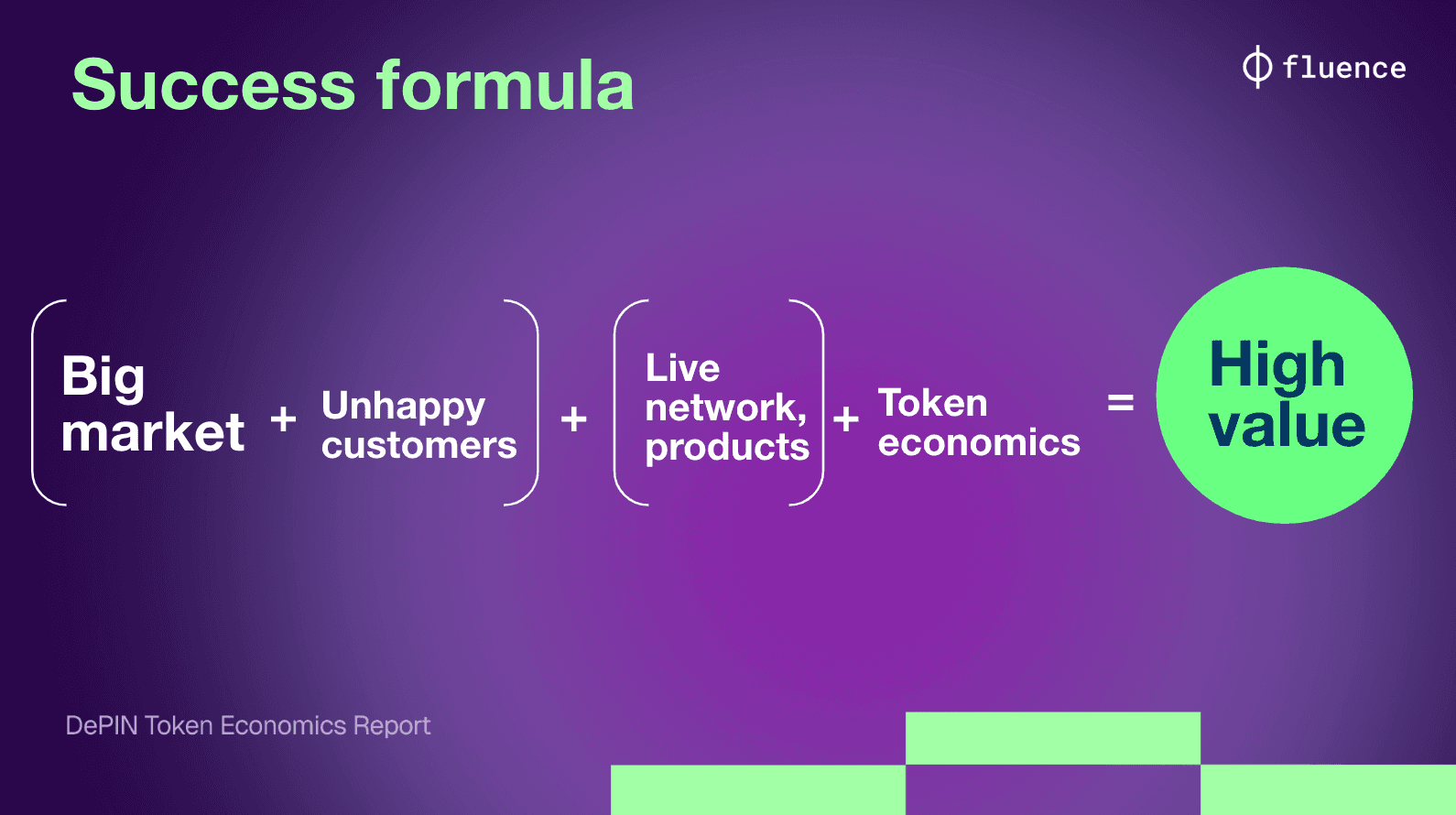

Tom argues that DePIN is winning on fundamentals. Traction without tokenomics is useless. Tokenomics without usage is hype. Together? It works. The formula:

📈 Real-world traction examples:

Filecoin: 2 exabytes stored

Grass: 2.5M bandwidth providers, $75M revenue

GeoNet: 10,000 RTK antennas, 2x centralized competitors

HiveMapper: 450K km mapped, 8,000 drivers

Helium: 400K phones daily, Telefonica integration

Token Economics: Buy-and-Burn vs Stake-to-Scale

DePIN projects use two successful models:

Buy & Burn (e.g., GeoNet)

Revenue buys tokens on-market and burns them

80% of Geo’s revenue fuels token demand

On-chain transparency verifies traction

Stake-Based Scaling (e.g., Fluence)

Providers are paid in fiat

Token holders stake to secure compute

Higher usage = more stake = reduced supply

Case Study: Fluence’s Fiat-Based Stake Architecture

Fluence requires $12,000 in staked FLT per CPU — pegged in fiat to ensure stability. As the network grows, so does stake demand. This allows institutional hardware providers to stay token-agnostic while investors secure the network.

Network live with 6 data centers

First clients in alpha, $6M ARR pipeline

Roadmap: SLA support, scaling institutional onboarding

The DePIN Pledge: Towards Infrastructure Sovereignty

To close his talk, Tom introduced the DePIN Pledge — a commitment by companies to decentralize at least one layer of their infrastructure (compute, storage, connectivity) by the end of 2025.

This movement already includes leaders across DePIN — aiming to reduce dependency on hyperscalers and break data monopolies.

"A few companies control the internet, AI and data. DePIN is the only viable alternative"

What does it take to win in Web3 infrastructure?

A huge, broken market

Frustrated customers

Working products

Verified on-chain token economics

That’s the DePIN formula.

🔗 Learn more in DePIN Economics Report by Tom Trowbridge: https://depined.xyz/report